Cash: circulation of cash. Cash turnover

( Federal Law “On the Central Bank Russian Federation(Bank of Russia)" dated July 10, 2002 No. 86-FZ)

The monetary system of the Russian Federation consists of the following elements: the monetary unit, the issue of banknotes and the organization of monetary circulation.

Official monetary unit (currency) The Russian Federation is the ruble. The introduction of other monetary units on the territory of the Russian Federation and the issuance of monetary surrogates are prohibited.

Official ratio between ruble and gold or others precious metals not installed.

The issue of cash, the organization of its circulation and its withdrawal from circulation on the territory of the Russian Federation is carried out exclusively by the Bank of Russia.

Banknotes and coins of the Bank of Russia are the only legal means of payment on the territory of the Russian Federation. Their counterfeiting and illegal production is punishable by law.

Banknotes and coins are unconditional obligations of the Bank of Russia and are backed by all its assets.

When exchanging banknotes and coins of the Bank of Russia for banknotes of a new type, the period for their withdrawal from circulation cannot be less than one year, but not exceed five years.

The Bank of Russia exchanges old and damaged banknotes without restrictions in accordance with the rules established by it.

The Board of Directors decides on the release of new banknotes and coins into circulation and the withdrawal of old ones, approves the denominations and samples of new banknotes, the description of which is published in the media.

The decision on these issues is first sent to the Government of the Russian Federation.

For organizational purposes cash circulation on the territory of the Russian Federation, the Bank of Russia is assigned the following functions:

forecasting and organizing production, transportation and storage of banknotes and coins, creating their reserves;

establishing rules for the storage, transportation and collection of cash for credit institutions;

establishing signs of solvency of banknotes and the procedure for replacing damaged banknotes and coins, as well as their destruction;

determination of the order of business cash transactions for credit institutions.

Organization of cash circulation in the Russian Federation

Organizations, enterprises, institutions, regardless of their organizational and legal form, store available funds in bank institutions in the appropriate accounts on contractual terms.

Cash received at the cash desks of an enterprise must be handed over to banking institutions for subsequent crediting to the accounts of these enterprises.

Cash is handed over by enterprises directly to the cash desks of bank institutions or through joint cash desks at enterprises, as well as to enterprises of the State Committee of the Russian Federation for Communications and Informatization (Goskomsvyaz of the Russian Federation) for transfer to the appropriate accounts in bank institutions. Cash can be deposited by enterprises on contractual terms through the collection services of banking institutions or specialized collection services licensed by the Bank of Russia to carry out relevant collection operations Money and other values.

The procedure and terms for depositing cash are established by bank service institutions for each enterprise in agreement with their management. In this case, the following deadlines for the delivery of cash by enterprises may be established:

for enterprises located in locality, where there are bank institutions or enterprises of the State Committee for Communications of Russia - daily on the day cash is received at the enterprise’s cash desks;

for enterprises in which, due to their activities and operating hours, as well as in the absence of evening collection or evening cash desks, bank institutions cannot hand over cash to bank institutions or State Committee for Communications enterprises every day at the end of the working day - the next day;

for enterprises located in a populated area where there are no banks or State Committee for Communications enterprises - once every few days.

Cash desks of enterprises can store cash within the limits established by the banking institutions that serve them in agreement with the head of the enterprise. The limit on the balance of cash in the cash register is established by banking institutions annually for all enterprises, regardless of their organizational and legal form and field of activity, that have a cash register and carry out cash payments. The cash balance limit is determined based on the volume of cash turnover of the enterprise, taking into account the peculiarities of its operating mode, the procedure and timing of depositing cash at banking institutions, ensuring safety and reducing counter transportation of valuables.

Enterprises are required to hand over to banking institutions all cash in excess of established limits on the cash balance in the cash register.

Enterprises can keep cash in their cash registers in excess of the established limits only for issuance for wages, social payments and scholarships for no more than 3 working days (for enterprises in the Far North and equivalent areas - 5 days). After this period, unused amounts are handed over to banking institutions.

Enterprises do not have the right to accumulate cash in their cash registers for future expenses (including wages, social payments, scholarships) before the due date for their payment.

Enterprises can receive cash from bank institutions where appropriate accounts have been opened for the purposes established by federal legislation, other legal acts of the Russian Federation, and regulations of the Bank of Russia.

In order to ensure uniform use of cash resources and streamline the issuance of cash, bank institutions annually draw up a calendar for the issuance of cash for wages, social payments and scholarships based on information from enterprises about the size and timing of payment.

Territorial Branches of the Bank of Russia, on the basis of materials received from banking institutions, annually compile a corresponding payment calendar for the republic, territory, region (by month) and send it to the Bank of Russia for a summary for the Russian Federation as a whole.

Cash issuance to enterprises is carried out, as a rule, at the expense of current cash receipts at the cash desks of credit institutions.

To ensure the timely issuance of cash by credit institutions from the accounts of enterprises, territorial branches of the Bank of Russia or, on their instructions, cash settlement centers (RCCs) establish for each credit institution the amount of the minimum allowable cash balance in the operating cash desk at the end of the day.

In order to maximize the attraction of cash to their cash desks through the timely and complete collection of cash proceeds from enterprises, bank institutions at least once every two years check compliance with the procedure established by the Bank of Russia for conducting cash transactions and working with cash.

Enterprises that do not comply with the procedure for conducting cash transactions and handling cash are subject to liability measures provided for by the legislation of the Russian Federation.

Territorial branches of the Bank of Russia exercise control over the work of bank institutions in organizing cash circulation, compliance by enterprises with the procedure for conducting cash transactions and working with cash. If credit institutions fail to comply with federal legislation, regulations and instructions of the Bank of Russia on these issues, financial sanctions are applied.

An increasing number of people in Russia use bank cards in stores to purchase necessary goods. However, cash is still relevant. The older generation often does not trust banks and is skeptical about cards. You also cannot pay with electronic banknotes at the market, where you can buy fresh vegetables, fruits, meat and other farm products, and in small kiosks. Today we will look at the features of using cash and its turnover.

Cash and its use

In countries with developed economies, the share of payments by bank cards exceeds 90%. Cash is not common here. Only 1% of the US population does not receive their salary on a bank card, 5% - in Canada, 10% - in the UK. In Russia, the sphere of cash circulation is quite extensive. After market reforms it reached 25%, but today it exceeds 40%. Cash currency is used in the following areas:

- Calculations of the population of the Russian Federation in retail stores, cafes and restaurants.

- Remuneration in many commercial firms.

- Depositing money by the population and receiving funds from the bank.

- Payment of pensions, scholarships and other transfers.

- Issuance of loans to individuals.

- Payment of dividends on securities to the public.

- Repayment of utility bills individuals.

Cash turnover between organizations and enterprises is insignificant. There are several types of money that participate in the circulation:

- Banknotes.

- Metal coins.

They are usually issued by central banks, sometimes also by the Treasury.

Definition of the concept

Cash turnover is a set of payments over a certain time, which reflect the movement of banknotes and coins as a means of circulation and payment. Today its share in Russia is more than 40%. Cash may begin to be used more for the following reasons:

- In conditions of various kinds of crises.

- When calculations slow down.

- In conditions bad organization interbank market.

- With the deliberate understatement of profits by enterprises to evade taxes.

The expansion of cash circulation leads to a decrease in the budget and an increase in the share of the black market. The result is widespread instability and scarcity. Bank account turnover is much easier to regulate and account for.

Basic principles

The Civil Code of the Russian Federation clearly regulates the rules of cash circulation. It establishes different payment procedures for individuals and legal entities. Cash in the company's cash register is limited. Its turnover is organized on the basis of the following principles:

- All businesses are required to keep cash in commercial bank accounts.

- For organizations of all forms of ownership, there are cash limits.

- Turnover management is carried out centrally.

- It is also the object of forecasting and planning.

- The organization of cash flow is carried out in order to ensure its stability, efficiency and elasticity.

- Cash currency is delivered to the company's cash desk directly from the bank that serves it.

Economic objectives

Cash circulation is carried out continuously. At its center are banks. Cash limits are set in order to speed up the circulation of cash. During the organization of turnover, the following tasks are solved:

- Determination of its volume, structure and trends.

- Regulation and direction of cash flows.

- Distribution of cash across the country.

- Determining the mass of money in the form of banknotes and coins in a country to calculate monetary aggregates.

- Establishing the level and procedure for collection and other methods of mobilizing funds by banks.

- Calculation of the issue result for a certain period.

Banks make a forecast of cash receipts and disbursements. It is done on the basis of incoming information for past periods.

Cash flow

The central link in turnover is banks. They are the ones who organize and regulate it. Money comes into circulation when it is transferred from reserves to working cash. After that, they end up in commercial banks. Most of the cash received is given to customers. Some of it remains in the cash registers of enterprises. The population pays in cash for goods and services. So they return to the cash desks of enterprises, then to commercial banks and higher on the list.

Procedure for handling cash

The procedure for conducting transactions at the cash desk is regulated by the Bank of Russia. He sets the rules and the order by which they are carried out. After payment is made in cash, the money ends up in the company's cash register. This means they are coming back into circulation. The legislation provides for the following types of liability for violation of cash discipline:

- For making settlements with other enterprises in excess of the established amounts. A fine of two times the amount is expected.

- For failure to receive cash. A fine of three times the amount is expected.

- For failure to comply with the procedure for storing funds. A fine of three times the amount is expected.

- For accumulation of cash in the cash register in excess of the established limit. A fine of three times the amount is expected.

The head of the organization is also responsible for allowing violations. An additional fine of fifty times the established minimum wage is imposed on him. Therefore, cash in the cash register is subject to strict control. The amounts of fines are subject to transfer to the federal budget.

Control authorities

Tax inspectors are checking cash discipline. In addition to cash documents, they can also request the machine itself. The procedure for conducting an audit is set out in the special administrative regulations of the Federal Tax Service. Employees of the latter have the right:

- Get access to cash register the enterprise where the inspection is carried out.

- Count your available cash.

- Check the availability of strict reporting forms.

- Demand detailed explanations in writing for each violation that was identified.

- Bring to administrative responsibility the enterprise that is the object of control.

Cash collection

Delivery of money from banks to enterprises and back is carried out special teams. The composition of the collection team depends on the volume and complexity of the operation. One of them is appointed as the main one. He receives a special power of attorney to accept valuables. If the team consists of two people, then the driver is appointed senior. Before the arrival of collectors, the cash at the cash desk is counted, the declared amount, banknotes and/or coins are prepared.

Forecasting and assessing the state of turnover

The stability of the economy depends on proper planning. The central and commercial banks forecast cash flow. They try to calculate the needs of economic turnover in future periods. This is the main task of banks. The turnover forecast compiled for the quarter is transferred to the cash settlement center 14 days before its start. The latter transmits information to the Bank of Russia. It forms its monetary policy on its basis. This way the Central Bank can take into account all the structural changes that occur in the economy.

The share of banknotes and coins turnover is much smaller than non-cash turnover, especially in developed countries. It grows during economic turmoil. The stability of the national economy depends on the clear organization of cash flow. It is associated primarily with the sphere of personal consumption. Commercial banks set limits on the amount of money that can be kept in a company's cash register. Cash in circulation has direct influence on the sustainable purchasing power of the population.

Cash turnover - it is a collection of payments over a period of time that reflects the movement of cash both as a medium of exchange and as a means of payment.

Scope of use of cash is mainly related to the income and expenses of the population and includes:

- settlements between the population and enterprises retail and catering;

- and payment of other cash income;

- depositing money by the population and receiving money from the bank;

- payment of pensions, benefits, scholarships, insurance compensation;

- issuance of consumer loans by credit institutions;

- payment for securities and payment of income on them;

- utility bills, payment of taxes to the budget by the population.

Thus, cash is used for the circulation of goods and services, for payments not directly related to the movement of goods and services. Cash circulation is carried out using various types money: metal coins, other credit instruments (bank bills, credit cards). Cash issuance is carried out, as a rule, by central banks and, in some countries, by the treasury. Between enterprises and organizations, according to general rule, cash flow is insignificant.

In countries with developed market economies, the share of cash payments in the entire payment turnover is 3-8%. This is achieved by translating wages to bank accounts. In the USA, less than 1% of the population receives wages in cash, in England - up to 10%, in Canada - 5%. All payments by the population for goods and services are carried out through checks and various payment cards.

Currently, the scope of cash turnover in Russia is unreasonably wide. If at the beginning of market reforms it reached 1/4, now it exceeds 40%.

Basic reasons for the expansion of cash turnover:

- economic crisis;

- cash crisis;

- non-payment crisis;

- slowdown in settlements;

- an insufficiently organized system of interbank settlements;

- deliberate reduction of profits in order to avoid taxes and expand cash payments outside banks.

A sharp expansion of cash circulation leads to an increase in distribution costs, the replacement of old banknotes with new ones, the emergence of “black cash”, and a shortage of tax payments. The results are deficits, financial instability. If money circulation passed through bank accounts, then the central bank would have more opportunities to take it into account, regulate it and have full information about the state of the economy. This would make it possible not to expand emissions. Unaccounted cash turnover is most often converted into foreign currency, and this requires the state to expand the process of issuing cash for payments from the budget.

The Civil Code of the Russian Federation regulates in detail the rules for using cash in the country. At the same time, different procedures for settlements with the participation of the population have been established, depending on the connection between cash payments and business activities. These payments are made by bank transfer. Persons not engaged in entrepreneurial activities make payments both in cash and non-cash. In accordance with the current procedure for organizing cash circulation, limits for the balance of cash in their cash registers are established for each enterprise, and all money exceeding the limit must be deposited with the bank servicing this enterprise. If there are several accounts in different banks, the enterprise, at its discretion, applies to one of them with the expectation of establishing a limit on the cash balance in the cash register. When checking a given enterprise, banks are guided by this limit. For an enterprise that has not submitted a settlement to the bank, the cash balance limit is considered zero, and undelivered cash is considered above the limit.

The issuance of cash to enterprises from the bank is carried out at the expense of current receipts in the bank's cash desks. To ensure timely cash payments, the RCC of the Central Bank of the Russian Federation establishes for each bank the amount of the minimum allowable cash balance in the operating cash desk at the end of the day.

Before the transition to market relations, cash turnover was planned and regulated on the basis of the balance of cash income and expenses of the population and on the basis of the State Bank's cash plan. With the help of these plans, the problem of balancing the money and commodity supply, the issue of the size of emissions, and the withdrawal of money from circulation were solved. The issue was of a directive nature. With the transition to market relations, emission plans ceased to be prescriptive. Forecasting the balance of cash income and expenses helps the Central Bank of the Russian Federation more fully take into account the demand of the population and predict the structure of consumer demand. If the income of the population exceeds expenses in the balance sheet, this means that the money supply in the hands of the population is increasing. In this case, cash issuance of money is required for customer service.

The main items of income of the population in this balance sheet: wages, pensions, benefits, scholarships, income from property and entrepreneurial activity. Today, the relationship between wages and property income has changed. Wages account for less than 50% of the population's income.

Expenses of the population - purchase of goods and services (2/3), mandatory payments and deposits (10%), purchase of currency (20%). The increase in the population's money has sharply decreased, as have savings in securities and deposits. Since 1991, cash turnover forecasts have been compiled in Russia, which are based on reliability and reality in determining changes in the cash supply in circulation. They are needed to determine the need for cash in Russia as a whole, by region and by bank. Forecasts of cash turnover reflect the volume and sources of cash inflows to banks, the size and direction of their issuance and, ultimately, the issue or withdrawal of money. Calculations are prepared by banks quarterly, distributed by month, and sent to the RCC of the Central Bank of the Russian Federation two weeks before the start of the quarter. Three days before the start of the quarter, the RCC of the Central Bank of the Russian Federation reports estimated data on turnover in the region as a whole for the receipt and disbursement of cash to banks.

The revenue side of cash turnover calculations reflects: trade revenue, revenue from transport enterprises, revenue from consumer services and entertainment enterprises, rent and utility bills, receipts to the accounts of agricultural enterprises, revenue from the sale of currency, revenue from communications enterprises, income from the sale of securities. The expenditure side reflects: wages, pensions, benefits, the issuance of funds for the purchase of agricultural products, and business expenses.

Currently, the Central Bank of the Russian Federation is moving to market forecasting methods related to establishing the volume of refinancing, changing interest rates, using required reserve norms, and using monetary aggregate calculations. Open market operations of the Central Bank of the Russian Federation are increasingly becoming the main method of regulation. In this case, a comprehensive system for regulating cash flow is used.

The issue of money involves ensuring the money supply from the following sources:

- commercial bank lending:

- state lending:

- increase in gold and foreign exchange reserves.

In the first case, the issue is secured by bills and others, in the second - by government bonds and obligations, in the third - it does not require collateral, since gold and currency are collateral.

The assets of the Central Bank of the Russian Federation serve as support for the issue of banknotes, while the Bank of Russia determines the procedure for conducting cash transactions, establishes rules for the transportation, storage, and collection of money, forms a mechanism for creating reserve funds of banknotes and coins, and determines the procedure for replacing and destroying damaged money. The functions of cash regulation of the money supply are assigned to the RCC of the Central Bank of the Russian Federation, which are organized at the main territorial departments of the Bank of Russia, where reserve funds of banknotes and coins are created. They are necessary to ensure emission, regulate the banknote structure of the money supply, replace damaged banknotes and save transportation costs.

In addition, the RCC of the Central Bank of the Russian Federation has created circulating cash desks that accept and issue money during the operating day. The balance of money in the cash register is limited, the surplus is transferred to the reserve fund. Cash services for commercial banks are provided on a contractual basis. The issuance of money, the acceptance of excess money, and cash services are carried out with the reflection of all transactions on correspondent accounts of banks and other legal entities.

Issue of cash is the release of money into circulation, which increases the amount of cash in circulation. The size of emissions in a command economy was strictly regulated by the state; in a market economy, there is a method for forecasting emissions. Issue operations (operations for the release and withdrawal of money from circulation) are carried out by:

- the central bank (bank of issue), which enjoys the monopoly right to issue bank notes (banknotes), which make up the vast majority of cash circulation;

- treasury (state executive agency), issuing small denomination paper notes (treasury bills and coins made from cheap types of metal, which are subject to developed countries accounts for about 10% of the total issue of cash).

The state is taking measures to regulate the production process, using the credit and monetary systems to weaken possible cyclical fluctuations in economic processes. In many countries, under the influence of increasing inflation, such a method of stabilizing the economy was used as targeting— establishing targets for regulating the growth of money supply in circulation and credit, which were to guide central banks. Since monetary circulation is influenced by various economic factors, and not only depends on the increase in the amount of money supply, many countries have now abandoned targeting monetary aggregates. In essence, targeting is the establishment of direct restrictions on changes in the volume of money supply. An important point that influences the effectiveness of regulating the dynamics of the money supply using targets is the order in which the latter are established: in the form of control figures (France), deposits (USA), forecasts (Japan).

Organization of cash flow

Let's look at the organization of cash flow using the example of the Russian Federation.

In Russia, cash circulation is regulated by the “Regulations on the rules for organizing cash circulation on the territory of the Russian Federation”, approved by the Bank of Russia - the Central Bank of the Russian Federation (CBRF). The provision is mandatory for implementation by territorial institutions of the Central Bank of the Russian Federation, cash settlement centers (RCCs), credit institutions and their branches, including institutions of the Savings Bank of the Russian Federation, as well as organizations, enterprises and institutions (hereinafter referred to as enterprises) on the territory of the Russian Federation.

According to the regulation, all enterprises, regardless of their organizational and legal form, store available funds in bank institutions in appropriate accounts on contractual terms.

Cash received at the cash desks of enterprises is subject to delivery to banking institutions for subsequent crediting to the accounts of these enterprises.

Cash will be handed over by enterprises directly to the cash desks of bank institutions or through joint cash desks at enterprises, as well as by enterprises of the State Committee of the Russian Federation for Communications and Informatization (Goskomsvyaz of Russia) for transfer to the appropriate accounts at bank institutions.

Acceptance of cash by banking institutions from serviced enterprises is carried out in the manner established by the “Regulations on the procedure for conducting cash transactions and the rules for storage, transportation and collection of banknotes and coins of the Bank of Russia in credit institutions on the territory of the Russian Federation” (as amended by the instructions of the Central Bank of the Russian Federation dated February 27 2010 No. 2405-U). The procedure and terms for depositing cash are established by bank service institutions for each enterprise in agreement with their managers based on the need to accelerate the turnover of money and timely receipt of it at the cash desks during the working days of bank institutions. The deadlines for the delivery of cash by enterprises are expected, as a rule, to be daily.

Cash accepted from individuals for the payment of taxes, insurance and other fees is handed over by the administrations and collectors of these payments directly to banking institutions or by transfer through enterprises of the State Committee for Communications of Russia.

Cash limits kept in the cash registers of enterprises on a daily basis are established by the banks servicing them in agreement with the heads of these enterprises. At the same time, the specifics of the enterprise’s activities are taken into account. The cash limit as directed by the bank can ensure normal operation of the enterprise in the morning next day, the limit can be determined within the limits of average daily cash revenue, etc. Banks issue cash to enterprises, as a rule, at the expense of current cash receipts at the cash desks of credit institutions.

Cash in credit institutions serviced by cash settlement centers (CCS) is regulated in a similar way.

To ensure the timely issuance of cash by credit institutions from the accounts of enterprises, as well as from accounts on deposits of citizens, territorial branches of the Bank of Russia or on their instructions, the RCCs establish for each credit institution and their branches the amount of the minimum allowable cash balance in the operating cash desk at the end of the day.

The establishment of limits on the working cash registers of cash settlement centers and their reinforcement are carried out in accordance with the “Instructions for issuing and cash work in institutions of the Bank of Russia” as amended. instructions of the Central Bank of the Russian Federation dated February 27, 2010 No. 2405-U.

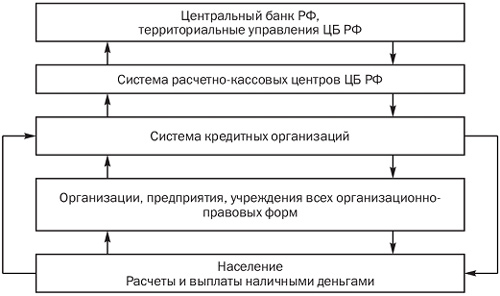

Let's consider the scheme of cash turnover in the Russian Federation (Fig. 2.1).

Rice. 2.1. Scheme of cash flow in Russia

The main links of cash circulation

The initial impulse that triggers the cash flow mechanism is the corresponding directive of the Central Bank of the Russian Federation to cash settlement centers. According to it, cash is transferred from their reserve funds to the working cash registers of the RCC. And thus they go into circulation. From the working cash desks of the RCC, cash is sent to the operating cash desks of credit institutions (commercial banks). Part of this money serves interbank settlements, part is sent as loans to other banks, but most of cash is issued to legal entities and individuals served by this commercial bank.

Part of the cash in the cash registers of organizations, enterprises, institutions is used for settlements between them, but the majority is transferred to the population in the form of cash income (salaries, pensions, benefits, etc.).

The population uses cash for mutual settlements, but most of it is spent on paying taxes, rent and utility bills, purchasing goods and paying for services, paying insurance, rent payments, etc.

Accordingly, money from the population goes either to the cash desks of trade enterprises, the State Committee for Communications of Russia, as well as enterprises providing services to the population, or directly to the operating cash desks of commercial banks.

Forecasting and assessing the state of cash flow

To determine the volume, sources of cash receipts at the cash desks of banking institutions and the directions of their issuance, as well as their release or withdrawal from circulation in regions, territories, republics and the Russian Federation as a whole, a forecast of cash turnover for each quarter is compiled.

To determine the need for cash, forecast calculations are made of the expected receipts in their cash registers and cash disbursements based on the time series of the “Report on Cash Turnovers of Bank of Russia Institutions and Credit Institutions” or on the basis of cash requests from serviced enterprises.

Calculations of expected cash receipts at the cash desks of credit institutions (commercial banks) and their disbursements are compiled quarterly, distributed by month. The results of cash receipts and expenses are reported to the RCC, in which the correspondent account of the credit institution is opened, 14 days before the start of the forecast quarter.

Cash settlement centers make forecasts of cash turnover in terms of receipts, expenses and emission results in general for the credit institutions they serve based on an analysis of the turnover of cash passing through their cash desks and relevant messages from credit institutions. Calculations are carried out quarterly with distribution by month and 7 days before the new quarter are reported to the territorial branch of the Bank of Russia. This is necessary for predictive calculations of the size and, if necessary, the issue of money in order to reinforce the working cash registers of the RCC.

To determine expected changes in the cash supply in circulation and the needs of enterprises for cash, territorial branches of the Bank of Russia draw up forecasts of cash turnover for the region, territory, and republic according to the sources of cash receipts at the cash desks of bank institutions and the directions of their issuance for the coming quarter. This work is carried out on the basis of an assessment of the prospects for the socio-economic development of the region, reporting data on cash turnover for previous periods, as well as information received from the RCC and banks on the projected cash turnover and emission result.

The territorial institutions of the Bank of Russia take into account the predicted results of the issue of money when developing measures to organize cash circulation in the region, as well as when drawing up plans for the delivery of cash to the reserve funds of cash settlement centers.

Regional branches of the Bank of Russia analyze the state of cash circulation in the regions on a quarterly basis.

The objects of analysis are: emerging trends in cash turnover and its structure; sources of cash receipts at the cash desks of bank institutions and directions for their withdrawal from the cash desks of bank institutions; speed of cash return to the cash desks of bank institutions; ongoing changes and trends in the economy; changes in the consumer price index; the state and development of non-cash payments between legal entities and individuals; the level of collection of cash proceeds (especially trade) generated in the consumer market. The territorial distribution of the issue of money in circulation, the reasons for the increase in the issue (reduction in withdrawal) of cash are studied; unused opportunities for bank institutions to mobilize internal cash resources to meet the cash needs of enterprises; results banking control ensuring that enterprises comply with the procedure for conducting cash transactions and working with cash; ongoing changes in the directions of use of cash income of the population and the sources of their formation; the state of spending by legal entities on wages and social payments; reasons for the formation of overdue debts for the payment of funds for wages and pensions.

Cash received at the cash desks of organizations is subject to delivery to credit organizations for subsequent crediting to the accounts of these organizations. The procedure and timing for the delivery of cash are established by the servicing credit institutions of each organization in agreement with their managers based on the need to accelerate the turnover of money and timely receipt of it at the cash desks during the working days of the credit institutions. In this case, the following deadlines for the delivery of cash to organizations may be established:

For organizations located in a populated area where there are credit organizations or communication organizations - daily on the day cash is received at the organizations' cash desks;

For organizations that, due to the specifics of their activities and operating hours, as well as in the absence of evening collection or evening cash desks of credit institutions, cannot deposit cash at the end of the working day every day at banks or communication organizations - the next day;

for organizations located in a populated area where there are no banks or communications organizations, as well as those located at a remote distance from them - once every few days.

Cash desks of organizations may store cash within the limits established by the credit institutions servicing them in agreement with the heads of the organizations.

The limit on the balance of cash in the cash register is established by credit institutions annually for all organizations, regardless of their legal form and field of activity, that have a cash register and carry out cash transactions.

calculations.__

Organizations are required to hand over to credit institutions all cash in excess of established limits on the cash balance in the cash register. Organizations can store cash in their cash registers in excess of established limits only

for the issuance of wages, social payments and scholarships no more than three working days (for organizations located in the Far North and equivalent areas - up to five days), including the day of receipt of funds

funds in a credit institution. After this period, unused amounts of cash are handed over to credit institutions.

Credit organizations carry out inspections of compliance by organizations with the procedure for conducting cash transactions and working with cash, established by the Bank of Russia.

To check:

Information is selected on transactions carried out during the period under review regarding receipts (crediting) of cash to the organization’s accounts in a credit institution and their issuance (write-off) from the cash desk of the credit institution;

The amount of the established limit on the cash balance in the cash register is specified;

Availability of permission to spend cash proceeds from the organization’s cash desk and its conditions;

The agreed upon procedure and timing for the delivery of proceeds to the credit institution.

The results obtained are documented in a certificate of the results of checking the organization’s compliance with the procedure for working with cash.

During the audit of the organization, the following is considered:

≫ completeness of posting of cash received from a credit institution;

Completeness of deposit of funds to the cash desk;

The amounts and dates of cash deposits to the bank are compared with the entries in the cash book, and if there are discrepancies between the data and the entries in the cash book, the reasons for such discrepancies are clarified;

Compliance with the conditions for spending cash received at the organization’s cash desk agreed upon with the credit institution;

Compliance with the established maximum amounts of cash settlements between legal entities;

Compliance with the cash balance limit established by the credit institution at the organization's cash desk;

Maintaining a cash book and other cash documents.

Based on the results of the inspection, the inspector draws conclusions and makes the necessary recommendations to the organization’s management to eliminate existing shortcomings in processing cash transactions and working with cash.__

Procedure for cash service for clients

Acceptance of cash from organizations A credit institution is obliged to accept letters of credit from individuals and legal entities for crediting to bank accounts or exchange banknotes of the Bank of Russia in accordance with the Signs of solvency of banknotes and coins of the Bank of Russia Acceptance of cash from organizations to the cash register is carried out according to advertisements on cash payment

(Form No. 0402001), which is a set of documents consisting of an announcement for a cash contribution, an order and a receipt (Appendix 7). After receiving the cash, the cashier checks the amount indicated in the announcement for the cash contribution with the amount that actually turned out to be recalculated. If the amounts match, the cashier signs the announcement, the order, puts a stamp on the receipt and issues it to the depositor of funds. The cashier keeps the announcement and passes the order to the appropriate accounting employee. In cases where the cashier establishes a discrepancy between the amount of money deposited by the client and the amount specified in the announcement for cash deposits, the announcement for cash deposits is re-issued by the client for the amount of money actually deposited, the cashier crosses out the originally issued announcement for cash deposits and indicates on the back of the receipt actually accepted amount of cash and signs. An announcement for a cash contribution is sent to an accountant

The employee who makes corrections in the cash register draws up the newly received document and transfers it to the cash register. The originally issued advertisement and order are destroyed, and the receipt is sent to cash register documents. If the client has not deposited money into the cash register, the cashier returns the announcement for a cash deposit to the accounting employee. Entries in the cash register are canceled by announcing

The statement for the cash contribution is crossed out and placed in the cash documents.

4.2.2. Issuance of cash to organizations

Cash is issued to organizations from their bank accounts using cash checks. To receive cash, the client presents the

a gentle check to the accountant. After appropriate verification, he is given a control stamp from the cash receipt for presentation to the cashier.

Having received a cash check, the cashier:

Checks the presence of signatures of officials of the credit institution who issued and verified the cash check, and the identity of these signatures with the available samples;

Compares the amount entered in figures on a cash check with the amount indicated in words;

Checks the presence of the client’s signature on the cash receipt when receiving cash and the details of his identity document;

Prepares the amount of funds to be issued;

Calls the recipient of funds by check number and asks him for the amount of funds received;

Checks the number of the control stamp with the number on the check and sticks the control stamp to the check;

“re-counts the amount of funds prepared for withdrawal in the presence of the client;

Gives cash to the recipient and signs the check.

The cashier issues banknotes in full and incomplete bundles and full counterfoils according to the amounts indicated on the slips and parcels, coins - in full and incomplete bags,

bags, tubes according to the inscriptions on the labels of the bags and bags, tubes, provided that the packaging is kept intact.

Full and incomplete bundles of banknotes, bags, packages, tubes with coins and full spines of banknotes with damage to the packaging, as well as incomplete spines of banknotes, individual banknotes and coins are issued by the cashier by sheet and piece count. Transactions in which the client, without depositing funds, simultaneously presents a cash check and an advertisement for a cash deposit are not allowed. The recipient of the cash, without leaving the cash register, in the presence of a cashier, accepts banknotes according to the inscriptions on the top linings of the packs, checking the number of stubs in them, the integrity of the packaging and seals (cliché imprints) and the presence of the necessary details. Full spines, not packed in bundles, and individual banknotes are counted sheet by sheet, coins are counted by the inscriptions on the labels of bags with coins, checking the correctness and integrity of the packaging and seals, and bags, tubes and individual coins are counted by circles. The client has the right, at his own discretion, to recalculate the received funds in a credit institution. Delivery of cash to the premises for recounting by clients and recounting are carried out in the presence of one of the employees of the cash department of the credit institution. For shortages or surpluses of funds identified as a result of

recalculation, an act is drawn up.

4.2.3. Procedure for handling cash

but serving the population

Reception and issuance of cash to individuals under bank account (deposit) agreements is carried out according to incoming and outgoing cash orders(Appendices 8, 9), which contain the surname, first name, patronymic (if any) or other personal data of the client that allows him to be identified and reflected in the bank account (deposit) agreement concluded with him. Acceptance by a cashier of cash from an individual to carry out a transfer operation without opening a bank account, including for payment of utility, tax and other payments, is carried out according to a document intended for submission (filling out) by an individual when transferring funds without opening a bank account .

In the event of a discrepancy between the amount of money contributed by the client and the amount indicated in the cash receipt document, or if non-payment or dubious banknotes are detected, the cashier invites him to add the missing amount or returns the over-deposited amount of money. If the client refuses to add the missing amount, the cashier invites the depositor to refill the receipt cash document to the actual amount deposited. The funds received from the client are recalculated in such a way that he can observe the actions of the cashier. The client counts the funds received from the cashier without leaving the cash register. If the client has any claims regarding the received and recalculated amount of funds, the specified amount is re-calculated under

supervision of the cash register manager, who decides to withdraw the balance of funds in the cash register. In this case, the client is not allowed into the cash register premises.

Stages of the credit process.

Global banking practice, based on many years of experience in the changing conditions of the credit market and competitive rivalry of credit institutions, has developed rules aimed at implementing a balanced credit policy and allowing to significantly reduce the risk of loan operations. The lending process of any bank must be divided into several stages, each of which contributes to the quality characteristics of the loan and determines the degree of its reliability and profitability for the bank.

The lending process can be divided into the following stages:

1) consideration of a loan application and negotiations with a potential borrower;

2) assessment of the creditworthiness of a potential borrower and the risk associated with providing a loan;

3) drawing up a loan agreement and issuing a loan;

4) credit monitoring;

5) loan repayment.

A diagram of the organization of the credit process is shown in Fig. 5.2.

At the first stage, based on the client’s application, a study is carried out of the scope of his activity, the state of affairs in this business at the current moment and in the future, the main suppliers, buyers, legal status borrower's organization; determined

the purpose of the loan and its compliance with the current credit policy of the bank, the type of loan, term, sources of repayment of principal and payment of interest are established. The application is received by the credit officer, who, after reviewing it, conducts a preliminary conversation with the future borrower - directly with the head of the organization or his

representative. This conversation has great importance to resolve the issue of a future loan: it allows the loan officer not only to find out many important details loan application, but

Rice. 5.2. Scheme of organization of the credit process:

/ the client submits a loan application and a package of documents to the bank; 2 - cre

The quotation department advises the client; 3 - the credit department analyzes financial

financial situation and solvency of the client, connects the service without

danger and legal department, draws up a conclusion on the possibility of extradition

Chi loan with standard conditions or transfers documents to the credit

Committee; 4 - the credit committee considers the issue of lending to the client

i the upper limit (by terms or amount), the bank’s board makes a decision on

i |"" for children with non-standard conditions; 5a - upon receiving a positive

a decision is made to the operations department to issue a loan; 56 -

In case of refusal, the documents are returned to the client, he is informed of the reason for the refusal;

(\ the amount is credited to the client’s account; 7 - credit monitoring; 8a - loan repayment; 86 - if the loan is not repaid on time, an order is sent to Pank’s accounting department to transfer the corresponding amounts to the accounts for accounting for overdue interest and overdue loan debts, and also to change the group credit risk; 9 - after a certain period, documents on loans not repaid on time are transferred to the legal department for forced collection of the debt and drawn up psychological picture borrower, find out the professional preparedness of the management team of the organization, the realism of their assessments of the situation and prospects for the development of the organization. When receiving an application for a loan, the bank must study not only various aspects of the loan transaction, but also evaluate the

nal qualities of the borrower - the head of the company. When assessing the typicality of a client, the bank focuses on the following points: decency and honesty, professional abilities, age and health, the presence of a successor (at

i the range of illness and death), material security. The bank should not provide a loan to an organization whose management is not trustworthy, and if there is doubt that the borrower will strictly adhere to the terms of the loan

agreements. If the client has previously received a loan from this bank or he has a deposit account, this significantly increases his chances of receiving a loan. The head of the organization should ideally be of average return, have good professional training and sufficient experience in the field of commercial activity he represents. The bank must especially carefully monitor whether the company has obligations to other credit institutions. For example, if the buildings that a company owns are already mortgaged, this seriously undermines its solvency. It is very important to study the borrower’s reputation and credit history. Based on the analysis of the documents submitted by the client and the calculated solvency and creditworthiness ratios, an assessment is made of the client’s ability to repay the loan on time. An analysis and assessment of secondary sources of loan repayment is carried out, i.e. collateral, and also evaluates the quality of the loan as a whole. At the second stage, the credit officer, who, based on the results of the preliminary interview, continues to work with the client, must conduct an in-depth, thorough study of the borrower’s financial situation to assess his creditworthiness using various techniques. To carry out this work and make a decision on the possibility of providing a loan, certain documents are required from the client (Table 5.3). This is one of the most important stages of the lending process, since it allows a reasonable degree of accuracy to assess the borrower’s ability to repay the loan in a timely manner and in full, the degree of risk that the bank considers it possible to take on, the size of the loan and the conditions for its provision. At this stage, such bank services as the security service, legal department, economic department, and, if necessary, the securities department, foreign exchange department and others are included in the work. The legal department conducts a legal examination of the documents provided by the client, checks the ownership of the collateral, checks the legal capacity and capacity of the borrower, reviews the terms of the letter of guarantee, surety agreement and insurance agreement. The security service checks the identity of the borrower - an individual, the presence of state registration of a legal entity, and gives an opinion on the reliability of the borrower. For the purpose of increasing the security of lenders and borrowers by generally reducing credit risks and increasing the efficiency of credit institutions, a credit history bureau is used, the function of which is the formation, processing, storage and disclosure of information characterizing the timely fulfillment by borrowers of their obligations under loan (credit) agreements. A credit history bureau is a legal entity registered in accordance with the legislation of the Russian Federation, which is a commercial organization and provides services for the formation, processing and storage of credit histories, as well as for the provision of credit reports and related services.

The credit history bureau provides a credit report:

To the user of the credit history - upon his request;

To the subject of credit history - at his request to familiarize himself with his credit history;

In the Central Catalog of Credit Histories - the title part of the credit report;

To the court (judge) on a criminal case under investigation, and, with the consent of the prosecutor, to the preliminary investigation authorities on an initiated criminal case under their proceedings - an additional (closed) part of the credit history.

Credit institutions are required to provide the necessary available information regarding all borrowers who have agreed to its submission to at least one credit history bureau included in the state register of credit history bureaus.

The result of all the work carried out by the bank at the first and second stages of the loan process is the conclusion of a specialist from the bank’s credit department for issuing a loan. It must contain the following information:

Full characteristics the borrower himself;

An assessment of his business and financial situation, income plan

and expenses and payment calendar for the loan period;

Characteristics of the lending object, methods of collateral

loan and the main sources of its repayment;

An assessment of the reality of the terms of repayment of principal and interest, as well as an assessment of the bank’s credit risk for this loan.

The final decision on issuing loans in accordance with the decision-making powers is made by: the head of the credit department, the bank’s credit committee, and the bank’s board.

If a decision is made on the advisability of issuing a loan, the bank develops the terms of the loan agreement, i.e., the bank’s position is determined in relation to its main parameters: the form of the loan, the amount, terms and procedure for repayment, interest rate, collateral and other conditions. The form of the loan is selected depending on the category of the borrower and the characteristics of the loan object. For example, when financing a long-term project and when trust the bank can open a line of credit to the borrower. The loan amount is usually individual, as it determines

depends on the financial needs and capabilities of the lender and borrower, and it is very important to correctly assess it. Incorrect determination of the loan amount can cause serious problems during the lending process. Thus, if the loan amount is overestimated relative to solvency, the borrower may have difficulty repaying the debt in the future. Underestimating the loan amount can lead to difficulties for the client associated with the implementation of the project. Therefore, the bank, having received the client’s calculations, must itself assess the required loan amount, making the necessary clarifications. The bank must determine the final repayment period of the loan and

provide for conditions for extending the deadline for the return of funds (extension) in case of late receipt of funds. The longer the loan term, the higher the risk and likelihood that unforeseen difficulties will arise and the client will not be able to repay the debt in accordance with the agreement. The interest rate on the loan is determined by both parties by agreement and depends on the cost of credit resources, the nature of the loan and the degree of risk associated with it. In cases where the client's creditworthiness cannot be assessed with sufficient accuracy, bank lending rates are closely linked to the availability and reliability of loan collateral. The procedure for repaying the loan is determined by the bank in agreement with the client, depending on the size and regularity of profit, usually quarterly. For this purpose, a loan repayment schedule is developed. Correct definition The timing of debt repayment also has a significant impact on the completion of the loan transaction. If the bank sets too short a loan repayment period, the borrower may be left without the capital necessary for normal functioning, and profits will not grow as originally predicted. When choosing collateral, the bank must be guided by the following. The issue of security should be resolved after

how a decision was made on the acceptability of a loan transaction for the bank. The collateral can be accepted by the bank at its book value or based on an assessment by an expert company licensed to carry out appraisal activities. The estimated value of the property pledged is adjusted using correction factors. It must fully cover the amount of the loan and interest due for the use of this loan for the entire period until

dialect For example, if a loan in the amount of 100 million rubles is requested. for a period of two years at 20% per annum and the collateral is real estate, then its estimated value, taking into account an adjustment factor of 0.7, will be (100 + 40) million rubles. : 0.7 =

200 million rub. If a decision is made to refuse to issue a loan, the bank returns the documents submitted to the client and informs him of the reason for the refusal. At the third stage, the bank’s credit department draws up a loan agreement and a security agreement, the bank’s legal department conducts a legal examination of the concluded agreements and endorses them. A loan agreement is a detailed document that is signed by the participants in a loan transaction and which contains detailed description all terms and conditions of the loan.

A standard loan agreement includes the following sections:

General provisions, subject of the contract;

Terms of loan;

Terms of settlements and payments;

the rights and obligations of the borrower;

Rights and obligations of the bank;

Responsibility of the parties;

Settlement of disputes;

Contract time;

Legal addresses.

According to the loan agreement, the client is obliged to:

Repay the received loan and interest for using the loan on time;

Do not evade banking controls;

Do not worsen your economic and financial condition;

Comply with the intended purpose of the loan received;

Provide and guarantee the availability of collateral under the loan agreement throughout the entire loan period, i.e. until the day the loan is actually repaid.

Depending on the method of provision, the following may be issued:

Pledge agreement;

Surety agreement;

Bank guarantee;

Other agreements to secure a loan obligation.

The loan is issued on the basis of an order from the credit department of the bank’s accounting department signed by an authorized official

The order must indicate:

The name of the borrower and the number of his current account to which the loan is transferred;

Number and date of the loan agreement;

Method of providing credit;

Loan amount (loan limit);

Interest payment period and interest rate;

Loan repayment terms;

Type of security and its amount;

Credit risk group.

When issuing a loan, the bank's accounting department (operations department) opens an account and transfers funds from it to the borrower's personal account. At the same time, off-balance sheet accounts account for collateral for granted loans, obligations to provide loans in the form of an “overdraft” or under an open line of credit. In addition, a reserve for possible loan losses is formed within the prescribed period.

All documents on the borrower’s loan file are formed in the File, which indicates the name of the borrower, the number of the loan agreement, the date of its conclusion, the code, and the number of the loan account in the bank.

At the fourth stage, the bank exercises control over:

Firstly, compliance with the terms of each loan agreement (to ensure repayment of the loan amount on time and payment of interest on it);

Secondly, for the loan portfolio as a whole (to ensure minimization of credit risk and increase the share of profit and credit operations in general).

Igo is also a very important stage of the lending process, since 11) the ultimate goal is to ensure timely repayment of the loan 1.1 and interest on it. At this stage, the bank controls the regularity of interest payments for using the loan,

Conducts scheduled and unscheduled on-site inspections with the preparation of an inspection report. During such checks, it is clarified that the loan is spent for its intended purpose as provided for in the loan agreement. In addition, the bank checks for

deposits, contracts for the purchase and sale of inventory items, studies statements from the borrower’s bank and balance sheet as of the last reporting date and familiarizes the borrower with the act or certificate of the inspection.

The loan officer regularly notes in the credit position the movement of debt on the loan and the receipt of interest on it. If the client’s financial situation worsens and the risk of loan non-repayment arises, the loan officer notifies his management about this so that appropriate measures can be taken. The appearance of a problem loan is usually not unexpected: an experienced financier can spot the red flags long before the client's inability to repay the loan becomes apparent. Thorough Analysis financial statements In comparison with past reports, it reveals such alarming signals as a sharp increase in accounts receivable, a decrease in liquidity ratios, a drop in sales, operating losses, etc. If a bank discovers a bad loan, it must act immediately. The best way out- discussing matters with the borrower and developing a program to overcome the crisis situation. This option is preferable to declaring the borrower bankrupt. Prosecution of the borrower may have a negative effect if the latter proves that the bank’s actions caused him harm and led him to bankruptcy. If the client can be convinced that the situation can be improved, the bank may offer to sell assets, reduce staff, reduce overhead costs, change the marketing strategy

tag, change company management, etc. At the fifth stage, the loan is repaid. Legal entities repay the loan by writing off funds from

their bank accounts based on payment orders, as well as payment requirements of the creditor bank, if this is provided for by the terms of the loan agreement. Loan repayment by individuals is carried out by transferring funds from their bank accounts on the basis of their written orders, transferring funds through communication organizations or other credit organizations, as well as by depositing cash into the cash register. In case of untimely payment of interest and repayment of the loan, an order is sent to the bank's accounting department to transfer the corresponding amounts to the accounts of overdue loan debt, as well as to change the credit risk group. After a certain period, documents on loans not repaid on time are transferred to the legal department for forced collection of the debt. For violation of the deadline for repayment of the loan received, the client is obliged to pay increased interest to the bank, which must also be specified in the agreement. But this also has a significant drawback, since eventually the overdue debt begins to grow at double payment rates with the overdue interest being transferred to the same overdue loans account and then interest being charged on the interest. Once the loan and related interest have been fully repaid, the loan case is closed. A separate sheet indicates the dates of issuance and repayment of the loan, calculations for the accrual of interest and the dates of their transfer. A note is made “the loan was returned fully with interest, loan file No. closed (closing date).” The credit file is transferred to the archive, where it is stored for 3 years from the date of its closure. In accordance with the requirements of the Bank of Russia, all credit institutions must form reserves to prevent possible loan losses. Credit institutions submit to the territorial institutions of the Bank of Russia calculations of reserves for possible losses for I vessels issued to individuals and legal entities- to non-credit organizations quarterly, and to credit organizations - monthly.

The amount of reserves depends on the loan quality category. Depending on credit risk factors, loans can be classified into one of five quality categories (Table 5.4).

1) the financial position of the borrower (how stable and efficient is its activity, are there any negative trends that could lead to financial difficulties, or i e (the borrower is insolvent and declared bankrupt);

2) the quality of debt servicing by the borrower (how timely the obligations to repay the principal debt and interest on it are fulfilled, whether there has been an extension of the loan repayment period). The audit of the financial position and quality of debt servicing is carried out in accordance with the requirements established by the Bank of Russia and is assessed as good, average or bad depending on the results of the analysis. The determination of the loan quality category, taking into account the financial situation of the borrower and the quality of debt servicing, is made in accordance with Table.

The amount of the estimated reserve as a percentage of the principal amount of the loan for different categories of loan quality is:

first (highest) O

second 1-20

third 21-50

fourth 51-100

fifth (lowest) 100

The reserve for possible losses is created in rubles. Uncollectible loans and accrued interest on them are written off from the reserves created for them.

It is possible for a bank to insure a loan from an insurance company. If the credit transaction goes unfavorably, the insurance company gets involved. As part of an agreement with an insurance company, life insurance of the borrower, insurance

property accepted as collateral for a loan, etc.

10) Assessment of the creditworthiness of the borrower - a legal entity.